Irs Calendar Year 2025 Changes – In the year that a required minimum distribution (RMD) is due from a 401(k), IRA or other pre-tax retirement account, you’re required to withdraw a certain amount and pay your taxes due to avoid a 50% . The Internal Revenue Service announced Friday tax relief for residents and businesses in Florida that were affected by severe storms and flooding that began on Aug. 1. .

Irs Calendar Year 2025 Changes

Source : twitter.com

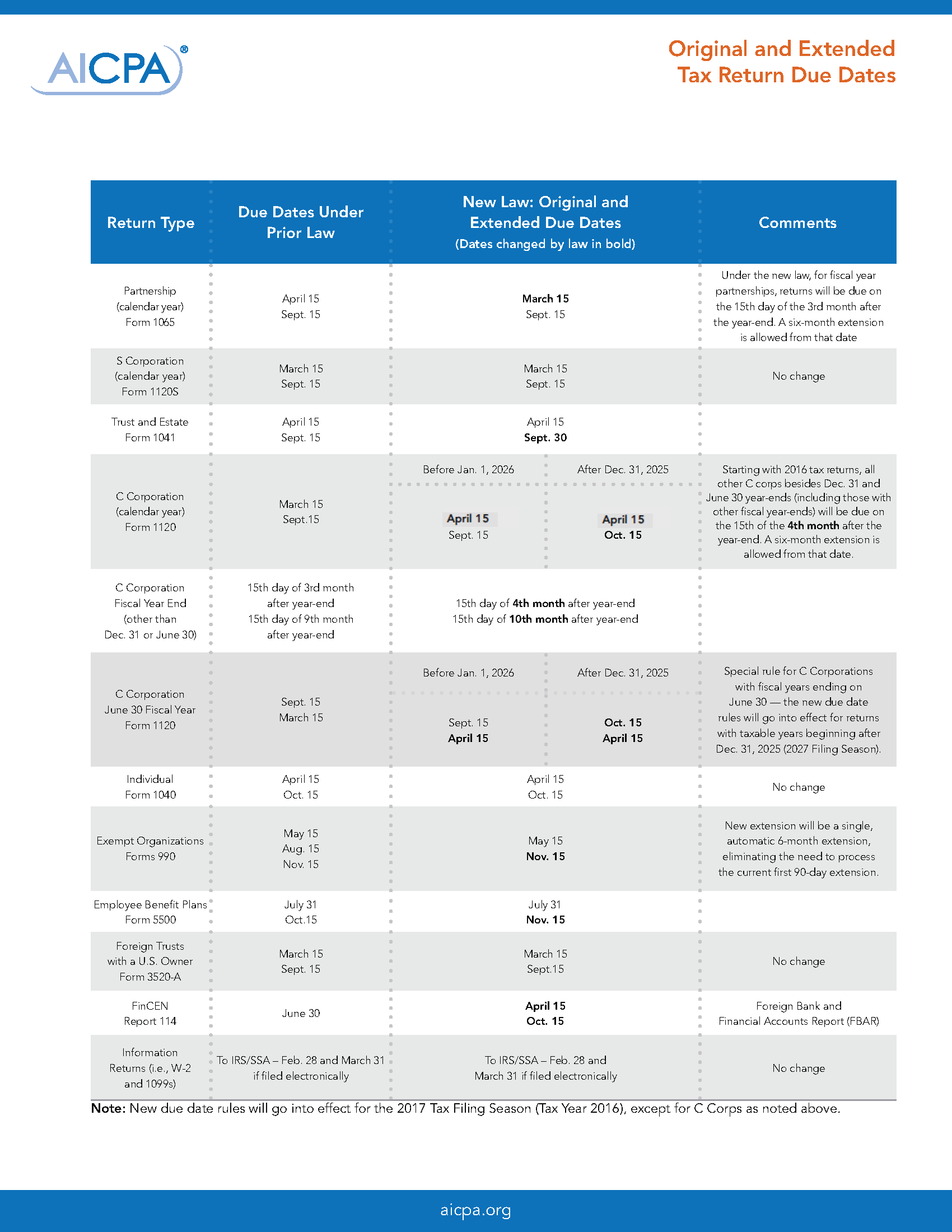

IRS Changes Due Dates for Certain Tax Returns Withum

Source : www.withum.com

Discover the major change from the IRS for residents of all states

Source : vibes.okdiario.com

Full Report Taxpayer Advocate Service

Source : www.taxpayeradvocate.irs.gov

2025 IRS Limits Forecast – March

Source : www.milliman.com

Join the Taxpayer Advocate Service at the 2024 IRS Nationwide Tax

Source : www.taxpayeradvocate.irs.gov

NEW FAFSA CHANGES FOR THE SCHOOL YEAR 2024 2025 | Blog

Source : www.accfs.com

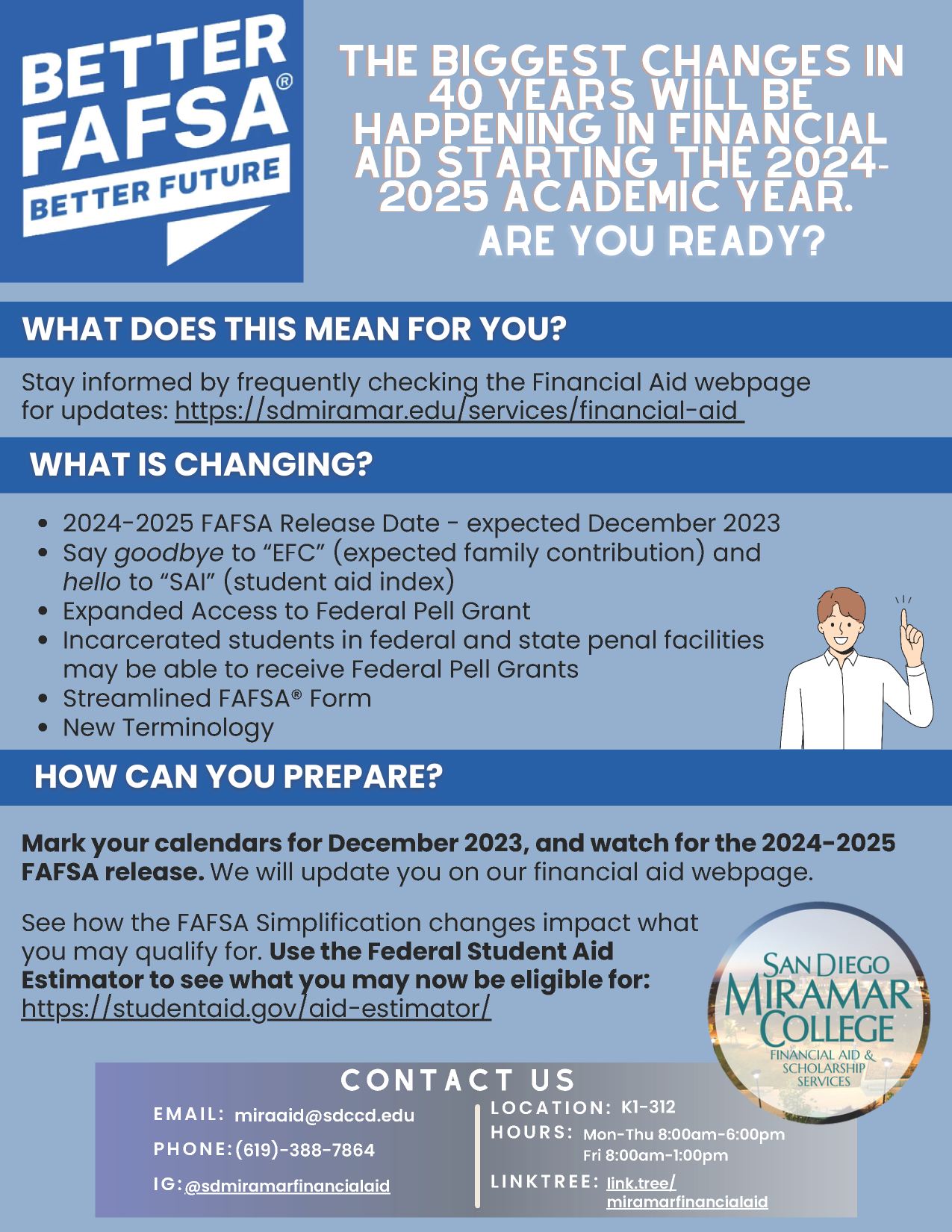

2024 25 FAFSA Simplification | San Diego Miramar College

Source : sdmiramar.edu

Applying for Financial Aid | Financial Aid | Mesa Community College

Source : www.mesacc.edu

American Rescue Plan Act of 2021 individual tax changes summary by

Source : www.taxpayeradvocate.irs.gov

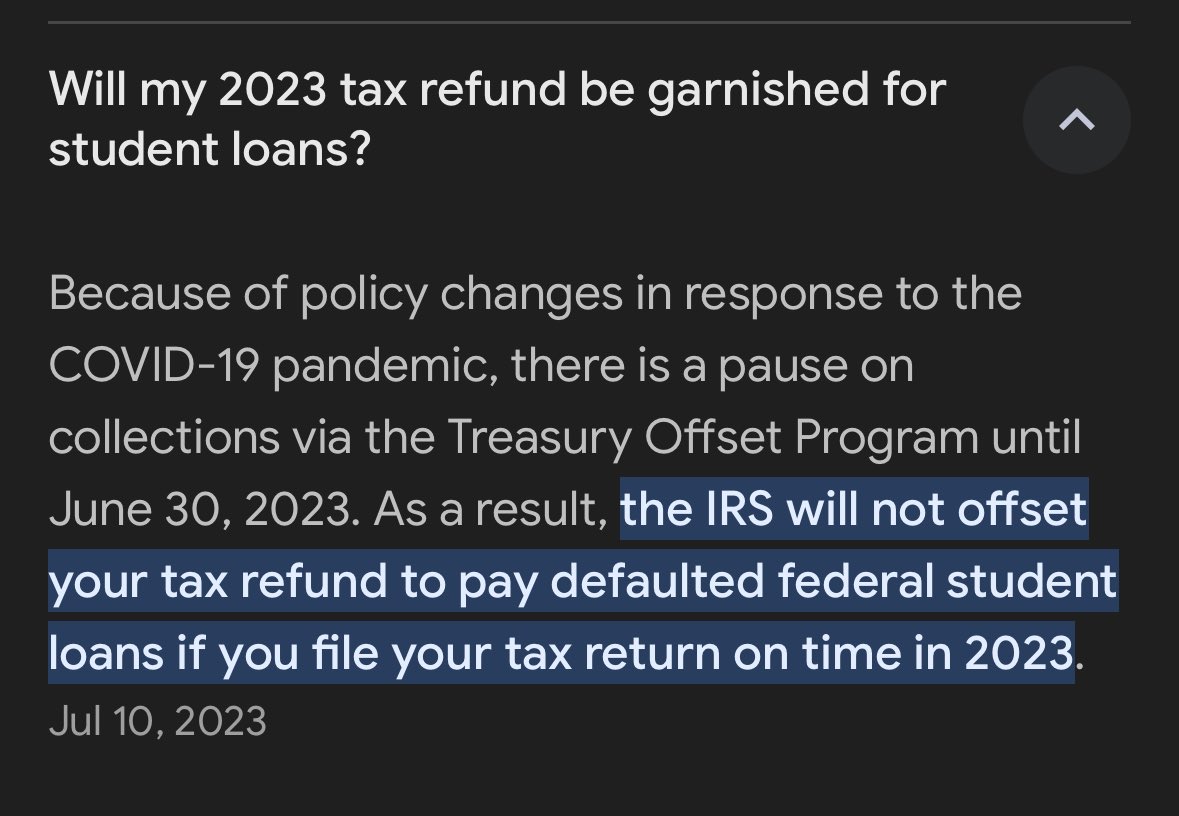

Irs Calendar Year 2025 Changes TIGHTEN UP on X: “FYI, when your student loans are in default, the : Final regulations published on July 19, 2024, provide insight into required minimum distributions under the SECURE Act. . The MPPP, sometimes referred to as “smoothing,” was established in the Inflation Reduction Act (IRA) and allows Medicare beneficiaries with Part D to opt into an alternative payment structure for .